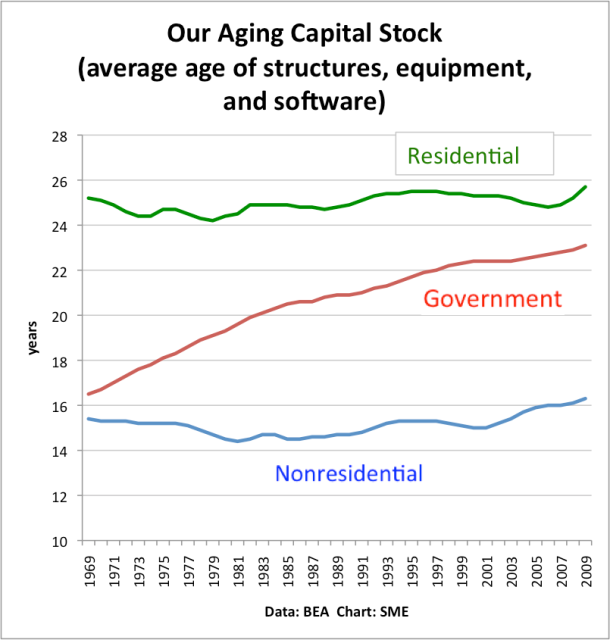

If things feel more decrepit and worn-out these days, it’s because they are. The average age of the U.S. capital stock is at a 40-year high in all three major categories: nonresidential, residential, and government. Take a look at this chart:

One unpleasant surprise after another, from the top down.

*The age of the residential stock is at its highest level in 40 years, despite the mammoth building boom of the 2000s.

*The age of the government capital has steadily risen over the past 40 years, suggesting great underinvestment in public infrastructure.

*The age of the private nonresidential capital stock has risen more or less steadily since the early 1980s, with a slight dip in the New Economy boom of the 1990s.

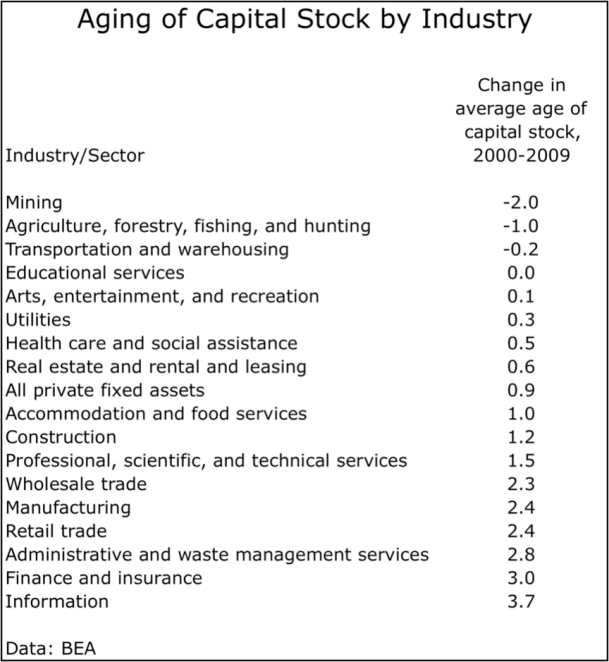

Let’s break it down by industry. This chart shows the change in the average age of the capital stock since 2000.

It’s kind of an odd and surprising picture. The sectors which got younger were mining, farming, and transportation. The information sector, which was supposed to be leading the economy, had the biggest rise in average age. That’s because we just weren’t investing enough in information technology over this stretch to make up for the aging of the old physical infrastructure.

Could you ground this in some examples? What is infrastructure in Finance and Insurance, for example? Retail Trade?

It’s a bit abstract for me…

Methodology is always important. Perhaps the information-based industries, near or at the bottom of the ‘By Industry’ list, had upgraded to better and better platforms which last longer. Industries which were not in or adjacent to the dot-com era tech upgrade updated their information capital stock later, as they became more comfortable with the platforms, and as prices dropped.

This tells us that we are on the brink of a tech boom.

After computers, software, and networking equipment become more than 5 years old, they just become unusable. They have to be upgraded.

Two points. I agree that we are on the verge of a communications/tech boom, as I’ve repeatedly written. But also in the current data, the average age of computers is only 1.2 years.

I take it that the average age of the American population is also at an all-time high.

The two are not unrelated.

I can understand how that might work for the residential stock, but why should the aging of the population increase the age of the nonresidential capital stock?

I take these charts to indicate that the quality of our capital goods is high and rising, with the goods not needing to be replaced for quite some time. Just the opposite of the common complaint about cheap Chinese goods now on the market.

I suspect that your data on IT may have been distorted by the 1990s tech boom.

If you look at the data on growth of industrial capacity you see that the 1990s booms caused industrial capacity to really surge in the 1990s. for example from 1975 to 1995 US industrial capacity grew at about a 2% rate. In the late 1990s this shot up to some 6% to 8% before falling back to around 1% since the 2000 recession.

If you assume a standard depreciation schedule — say 2 or 3 years — this would have generated a sharp increase in the old capital being depreciated in the early 2000s.

But has this happened in reality. In the 1990s the rate of new technology being introduced was so rapid that a 2 or 3 year old computer was really obsolete. But now the rate of progress has slowed so much that a four to six year old computer is perfectly fine for all but a select few purposes. You no longer have to replace your computer every 2 or 3 years.

the average age of a computer is 1.2 years in the data.

The average age of a computer is 1.2 years?

I find that hard to believe, even if the stock of computers is growing rapidly.

Not to be too arcane…the BEA gives two measures of age: One is current-cost weighted, and the other is historical-cost weighted. The current-cost figures is 1.2 years for computers and peripherals, and the historical-cost is 1.5 years for computers and peripherals. That fits a 3 year life cycle.

Your reference to sources is not enough for me to find the data.

Krugman makes a big deal about government stock age increasing, but is the government data comparable to the private? Does this include roads, bridges, dams? What dooes it look like if you seperate out the stuff that has not reached its design life?

A link would help answer those questions.

The data is available at:

http://www.bea.gov/national/FA2004/SelectTable.asp

Just curious, but don’t you want to control for the average age of firms in the industry, using something like Census LEHD (etc)?

My concern with the private sector numbers is that if the average firm in an industry is getting older, then its capital stock will get older not just because it doesn’t buy that much new capital, but because a lot of the capital it bought ten years ago is still good. For example, there were a lot fewer IT startups in the last ten years, so the firms you observe in 2009 are older on average than the firms you observe in 2000. As a result, you might just be showing which industries have been adding firms and which industries have been losing them, an interesting fact by itself but probably not your intention.

Still, cool picture; the government data are very interesting. Thanks for making it!

Yes, partly that’s what it’s showing.

I am not sure that “increasing age” is always indicative of a “failure to keep up”. For example, over the years the average age of our automobile fleet has increased because cars last longer (are useful longer) than they used to be. Growth in residential capital stock is a function of replacing residences which are no longer useful and of meeting the needs of an increasing population. It is pretty clear right now that people’s real residential needs are being more or less fully met.

And it can be argued that we are not keeping up with our infrastructure, but the average age of that infrastructure reflects many things — not just the adequacy of replacing things that wear out. The author seems to be inferring by measuring the age of existing capital stocks that everything that wears out must be replaced with something similar. An innovative society can use its creativity to replace the function of existing things (when the need for replacement arises) with new things which cost less in real terms than the original item. Any time a capital asset is replaced by something which is more durable and/or more versatile, it will create the appearance of aging without affecting the functionality of the asset.

As to IT, I am currently sitting in front of an iMac which I purchased over a year ago. It is “healthier” than previous PC’s I have owned at this age and will likely be useful for me for a year or two longer than previous PC’s. The age of my IT capital stock will clearly increase in the long run as a result of this purchase.

It’s called progress. There can be merit in purchasing capital stock in anything that will be useful and more versatile for longer than the things that it replaces.

The observation that the age of the residential housing stock is “at its highest level in 40 years, in spite of the building boom of the 2000s” is suspect. All of that increase took place in the last two years, which were marked by a dramatic slowdown in residential construction. Meanwhile, all existing stock continued to age by one day, each day.

This site might provide a better framework for understanding the country’s physical infrastructure:

http://www.infrastructurereportcard.org/

(it would appear they’re talking their book, but even with that grain of salt, it’s depressing – and scary)

Infrastructure is socialism since you share it, like in a community. And socialism is un-American. A train is a good example of that. Who wants to share a train…only Europeans and Asians! The only infrastructure that is not socialism is roads. Because you dot have to share your car….you can be a self-serving individual in your car. (Buses are socialism and should be banned). The first amendment doesn’t say ‘love thy neighbour’. The founding fathers were very clear on that. The government should ban all infrastructure spending (except roads) and spend more on things that can be consumed (such as cheez whiz and donuts) or blown up like bombs. The more consumption there is the faster the economy will go. And if there isn’t enough money just borrow some. It will all be good.

There are some very interesting concepts here; some a little ‘out there’ but interesting nonetheless. Would love to chat them up over a beer or two.

As someone that has been in the profession (civil engineering) for about 25 years I can tell you that the problems are massive and complicated. The main problem, as I see it, is that the problems are being dealt with on a primarily political level and without adequate input from the experts. Now, to be honest, we engineers are mostly responsible for allowing ourselves to being taken out of the decision process, but as long as that decision-loop flaw remains, so will the decline of our infrastructure.

Turkey from abroad need to warehouse we can deliver goods monthly or annual items, please write to know if there are places,

Rich in linoleic acid, vitamin E and many other essential fatty oils, it is especially effective for

the repairing skin around the eyes and is known to visibly reduce the appearance of fine lines and wrinkles.

These organic oils are combined in single or mixed combinations with herbs, carrier oils, carbon dioxides, and water to create the final products.

You will see harmful ingredients like Alcohol, Fragrances,

Dioxanes etc.

you’ll additionally wish to make certain you are taking out the filter after putting the coffee grounds as part of, because some machines definitely will also overrun if there are really any reasons seated inside the relax of the drip area and causing the block. I really like my bialetti coffee maker and additionally know it perhaps will make the better coffee of all of the separate choices about and additionally now I have relocated inside my personal new house containing the gas cooker im going in order to make the work to choose it more usually.

This is certainly utilized being a reference point around

final production system. Wind turbines need large components making it inconvenient to be created in different nations subsequently they have to be made yourself to be

assembled and also setup. Do some promotional in nearby papers, and also render up some fliers which you

can pass out to areas like, feed supply stores, hardware

retailers, and also other farm provide retailers.

A doo rag is actually just the wrap that appearance like a

scarf which wraps around the head.

Consider investing in stocks that pay dividends. That way,

even if the stock declines a bit in value, you are receiving

dividends that can offset some of the losses. And if the stock price rises, the dividends are a bonus that add

directly to your bottom line. They can also provide you with a periodic income.

__________________________________________________________________________

My tags: Penny stock trades

vous sont capables de droit maintenant inhaler

asoupir de soulagement carDISH Network apporte

votre tous les mode industrieà votre très propredoigts.

indépendamment de la question de savoir si vous comprendreil est oupas si vous amour mettre sur élégant vêtements puisvous sont généralement

probablement mettre sur certains de daujourdhui vogueAsian fashion.

ces fashions sontle vraiment dufois et également in cetteère trop ils dépeindre a et également vintagechercher.